Though the stock market is stuttering, there appears to be no slow in demand for servers in the third quarter of 2018.

IDC provided insight into the direction of the global server market in its latest Worldwide Quarterly Server Tracker for 3Q18. In the report, IDC stated global server revenue during the quarter reached $23.4 billion, for a 37.7 percent year-over-year gain.

The increased revenue is driven by a corresponding increase in the number of servers shipped. For the quarter, IDC reported 3.2 million servers were shipped globally, for an 18.3 percent gain over the third quarter of 2017.

Different parts of the world are growing at different rates. Asia/Pacific (excluding Japan) is the fastest growing area, with 46.5 percent year-over-year revenue growth. In contrast, server revenue growth in the U.S grew by 43.7 percent, and EMEA (Europe, Middle East and Africa) grew by a slower 24.5 percent.

In terms of server architecture, x86 servers continue to hold the lion’s share of revenue. For the the third quarter, x86 server revenue was $21.8 billion, for a 41.0 percent gain. In contrast, non-x86 servers grew by only 3.9 percent year-over-year to $1.6 billion.

“The worldwide server market once again generated strong revenue and unit shipment growth due to an ongoing enterprise refresh cycle and continued demand from cloud service providers,” Sebastian Lagana, research manager, Infrastructure Platforms and Technologies at IDC, wrote in a media advisory. “Enterprise infrastructure requirements from resource-intensive next-generation applications support increasingly rich configurations, ensuring average selling prices (ASPs) remain elevated against the year-ago quarter.”

“At the same time, hyperscalers continue to upgrade and expand their datacenter capabilities,” he stated.

Vendors

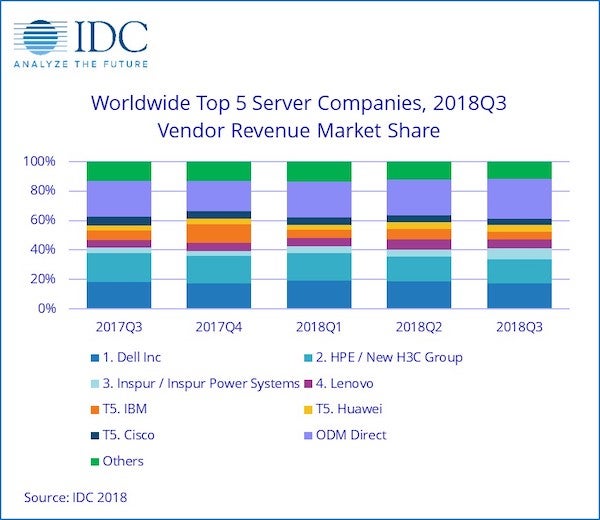

Dell now holds the top share in the worldwide server market with 17.5 percent revenue share and 33.3 percent growth.

Coming in second is Hewlett Packard Enterprise (HPE) at 16.3 percent, followed in third by Inspur/Inspur Power Systems at 7.3 percent. Rounding out the top five, Lenovo placed fourth at 6.2 percent, while IBM, Huawei, and Cisco were statistically tied for fifth.

Sean Michael Kerner is a senior editor at ServerWatch and InternetNews.com. Follow him on Twitter @TechJournalist.